Here I am, still talking about interest rates.

If you read my newsletter, you understand that the September 18th rate cut had mostly been “priced in” well before the actual meeting. You won’t be surprised that mortgage rates haven’t dropped significantly since Powell’s big announcement and 50 basis point reduction.

But mortgage rates are still down about a full point from their high, and people are reentering the market, trying to get in before it heats up (I could see next spring getting really busy).

Barring some incredibly unforeseen circumstance, this is about where we will be until after the election. Why? How do I know?

Keep reading and I’ll tell you.

Take a look at the chart below, courtesy of Urban Digs. Not only can you see how far we’ve come since the highs earlier this year (woo for buyers trying to lower their monthly interest payment), but the far right end might surprise you.

Rates have gone up, just a bit, since the Fed’s announcement. Their lowest was on September 9th, nine days before the Fed rate dropped. I explained that the drop was already priced in, which explains why there was no big mortgage rate cut, but why would they go up?

Because predictions of future Fed rate cuts changed. Because what economists and quants and the like see in our economy is different than it was on September 9th. Because these blue spots (speculated drops) are now all in the 300 range, rather than running down into the 200s.

Per the orange arrow above (provided by the lovely Noah of Urban Digs), in order for mortgage rates to drop significantly again, these blue bars need to move left. The more to the left, the more the market expects that the Fed will continue to announce drops, and that begins to bring mortgage rates down. Again, when these blue bars started moving back to the right in the past week or so, rates actually went up a little bit. All this while there was zero movement by the Fed.

Because remember, the Fed doesn’t directly control mortgage rates. You need to look at what banks and the financial sector believe to be true (and speculate will happen in the future).

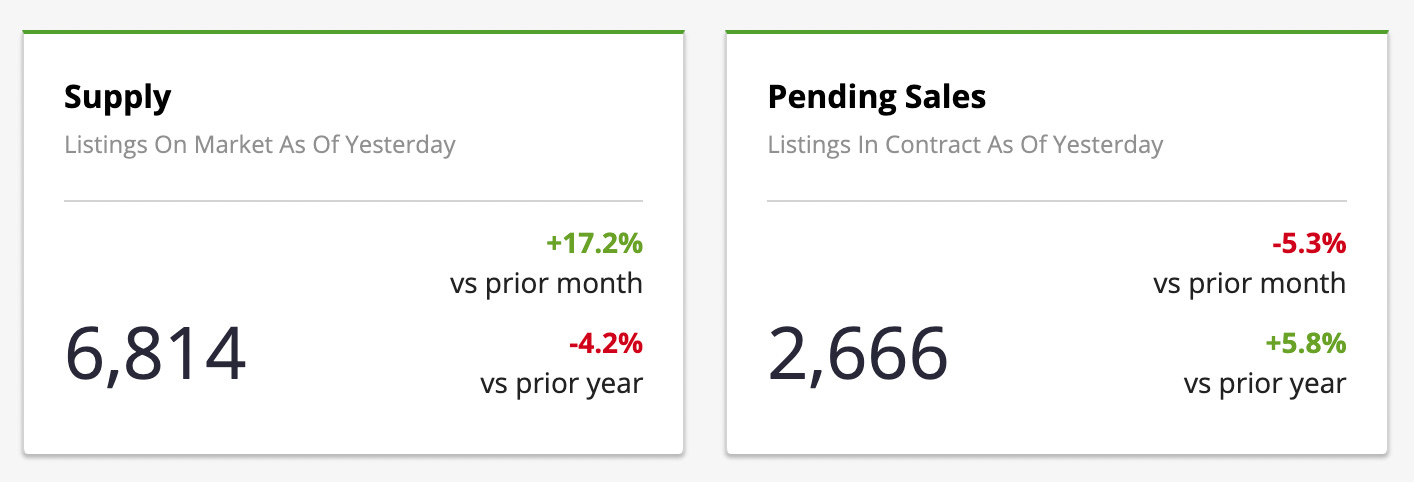

Inventory continues to climb; sales continue to close. And the new inventory is outpacing people going into contract, because that takes at a minimum a few days. Even in a bidding war, the seller usually likes to collect offers for about a week. Then they choose an offer and move forward with the due diligence, which takes from a couple days to potentially weeks. In buildings it can be drawn out by slow management, while in townhouses the delays can be permit/inspection related. Or the attorneys are slow. We see it all.

All this to say, inventory listed in the past couple weeks, even if an offer has been accepted, is showing up as active and available. NYC’s “accepted offers are just a handshake agreement” does funky things to the data.

And while this fall is probably a little bit slow given the election and geo-political nightmare that is our life right now, it’s not at a standstill by any means. People are LOOKING.

Reminder: October is often one of the busiest contract signed months, so let’s see how this year stacks up.

Considering buying? Email me at Sotheby’s and start the conversation now so you’re not playing catchup next month.

And if you’re like “nooooo I’m still waiting for home prices to drop because rates aren’t where I want them,” please review this video that I entirely stand by except that rates did go way higher than we expected. That was unprecedented but maybe I should have seen it coming. Regardless…

From BankRate: As of Tuesday, October 1, 2024, current interest rates in New York are 6.13% for a 30-year fixed mortgage and 5.63% for a 15-year fixed mortgage.

The day before the Fed announcement, September 17th, the 15 year rate was identical and the 30 year rate was about a quarter point higher.

Reminder: this doesn’t show you YOUR rate, especially in NYC where many loans are jumbo/non-conforming. And people pay down points or invest with a specific bank to get the best rate. You also “lock in” your rate during the transaction rather than knowing exactly in advance what you will end up closing with.

Your rate also depends on which type of loan, which banker, your credit score, and a whole load of other factors. So again, use this as a benchmark, not an exact calculation.

xo

Anna