This started as an exercise. After REBNY filed a legal challenge to the FARE Act, attempting to preserve a system of forced broker fees, I wanted to understand their arguments. What were the claims, what did I think, and how would the city respond? The deeper I went, the more context was needed. Now, it’s massive.

I hope this gives you an explanation of our unhinged rental market, shows why FARE is so important, and refutes claims my industry continues to make. I know I’m beating a dead horse, but I’m so tired of misrepresentations.

If you don’t want any background on the rental market, you can skip past the Plaintiffs section straight to the Lawsuit part.

Intro

First, I am not an attorney. None of this is legal advice. It’s my opinion.

Second, I’m not here to disparage specific agents, and intentionally avoid using/redact individuals’ names.

And finally, when I say a brokerage or firm is the plaintiff or that “they” are against something, I mean its owner(s)/leadership. The other agents associated with a firm are 1099 contractors, referred to as “agent(s).” This distinction is important, agent vs. brokerage, firm, or brokerage head. When I say “no fee” apartment, I mean the tenant can lease it without paying a broker, while “fee” or “tenant pays” apartments are the traditional ~15% fee model that FARE eliminates.

OK, here we go…

The Plaintiffs

Who wants to block FARE?

The plaintiffs suing to block FARE (and keep tenants paying forced broker fees) are two trade organizations: REBNY and NYSAR, five brokerages: Bohemia Realty Group, BOND New York Real Estate Corp, REAL New York, LLC, Level Group Inc. and Four Corners Realty, LLC, and two buildings/landlords: 21 West 74 Corp and 8 West 119th Street HDFC.

Why are they against it, in your opinion?

They give reasons in the complaint, but here’s my take.

REBNY & NYSAR

You all know about REBNY and its moves to stop the bill. The reasons can be summarized, in my opinion, as follows:

It represents landlords throughout New York State. This bill will keep landlords from passing fees to tenants, which will cost the landlords money. Landlords expect REBNY to stop bills like FARE.

It represents brokerage heads, like the co-plaintiffs, that do significant business representing landlords but making tenants pay. The brokerages also expect REBNY to stop bills like FARE.

REBNY collects millions of dollars per year in dues from residential agents, even if these agents do not do a single transaction. FARE’s passage makes REBNY look ineffective, so more brokerages may opt out of REBNY membership, reducing revenue.

NYSAR is the New York State Association of Realtors, our version of NAR. I believe it is against FARE for roughly the same reasons, with a greater emphasis on 2 and 3.

Landlords

I put these before brokerages because I go real deep in the next section. I don’t even think I need to say “in my opinion here,” because math, but I will. Here’s my opinion:

Landlords that don’t normally pay broker fees and instead make tenants pay want to keep that system. It either saves them time/money or actively earns them commission (more on that below….).

Brokerages

Bohemia Realty Group, BOND New York, REAL New York, Level Group, and Four Corners Realty are brokerages with a focus on exclusive landlord portfolios, although they do other business as well. Here’s why I think they’re fighting FARE:

Their landlord clients are against FARE. Joining this lawsuit shows they’re fighting and looks good. This will help them keep these landlords’ business when FARE takes effect.

They use the tenant-pays model to attract new agents. Agents generally pay desk/resource fees to their brokerages, whether or not they’re earning money.

Brokerages tend to take ~50% of every commission earned by a rental agent. It keeps the firms running and pays leadership. If total commissions drop because agents can no longer “double dip” and charge both sides, or because landlords hire other brokerages instead, pay less, or rent the units themselves, it will reduce what the plaintiffs earn.

A lot of brokerage executives, including at least some plaintiffs in this suit, own rental buildings. For example, 21 West 74th Street and Four Corners Realty are both owned by the same person. One guy owns the building and brokerage, which rents out units in the building and has tenants pay the broker fee. This is actually very common; someone owns a rental and also acts as the exclusive broker, charging the tenants both rent and a broker fee to move in. FARE will eliminate this practice.

To explain the rest, you need some background.

(A “brief” interlude to explain how rentals work)

When a tenant reaches out to an agent with exclusive listing (i.e., most listings on StreetEasy, a site pulling from RLS/MLS, Zillow, Trulia, or apartments.com), and that agent wants to collect a fee from the tenant instead of their landlord client, it is currently allowed. It is usually considered “dual agency.”

There are two basic requirements.

Advance Informed Consent: The agent must, on “first substantive contact,” explain and present an “agency disclosure form,” telling the tenant that their brokerage has an exclusive agreement with the landlord, and that the agent will be a “dual agent” representing both sides.

Dual Loyalty: The agent must advocate as equally as possible for both the landlord and tenant.

The first requirement is rarely followed. Tenants often don’t understand what they’re signing or feel they have no choice. A lot of agents are poorly trained, filling out the forms incorrectly and waiting until lease signing to throw something down in front of the tenant. It’s not necessarily intentional — agents may be showing dozens of people every day during busy season — but it’s a problem.

The second requirement is essentially impossible given the power imbalances and record low vacancy in our rental market. Even if you don’t hold a “broker fee bidding war” and give the tenant a discount (anything under 15%), if you refuse to submit their application unless they pay you a certain amount, you’re not really advocating for them. This happens all the time, because it’s structurally inevitable. Often, it’s in the listing itself.

At the June hearing, anti-FARE panels kept referencing dual agency, saying tenants pay landlords’ agents because they’re actually working on tenants’ behalf. But what about the above plaintiff, acting as both landlord and broker while charging the tenant a predetermined, 12% fee? Is he claiming dual agency? And, if not, if he only represents his own interests, why does he deserve to collect from the tenant?

It is basically impossible to do dual agency correctly in the rental market as it exists, especially when the brokerage and landlord are sometimes the same person. I am not suggesting that agents are criminals or should work for free. I am saying that, because of the reality of our market, we need a different model for rentals where everyone negotiates agreements up front with the party hiring them. Hence, FARE.

But wait, there’s more.

Often, when a tenant reaches out to a rental listing, the specific unit is no longer available and the agent offers to show other properties instead. It may be a bait and switch, but the market moves quickly and this isn’t necessarily sketchy.

It gets sketchy when the agent takes the tenant to a different unit. In the agent’s mind, they are now working on behalf of the tenant as a “tenant’s agent.” The tenant doesn’t always see it that way or get the distinction. They reached out to get a specific apartment they saw online; they didn’t necessarily want to hire this person to represent them city-wide. And, as you’ll see below, the agent often isn’t working as a tenant’s agent, even if they think they are.

If the agent takes that tenant to any other apartment represented by their brokerage, it is still dual agency. Agency is decided at the brokerage level, not the individual agent level. So John can’t just claim that Sam is the listing agent on 5B while John is the listing agent on 6A. John and Sam are both working on behalf of the landlord because their brokerage has an exclusive agreement with the property owner.

If the agent takes the tenant to a unit exclusively listed by a different brokerage, they are considered to be working on behalf of the tenant. They still need to provide the tenant a disclosure form at the start, explaining that the tenant is hiring them and that the tenant also has the option to go directly to these other exclusives on their own. Unfortunately, not all agents make this clear. It’s easy to mislead a prospective tenant, intentionally or otherwise.

Some firms actively promote shady practices, while others turn a blind eye or may not realize what’s happening. There is as much confusion on the agent side as on the tenant side, so a lot of this is unintentional. But when you advertise that you can show other properties directly on your exclusive listings, as at least some of the plaintiffs do (see above), you are blurring the line between listing agent and tenant side agent.

Which brings us back to…

Why are the brokerage plaintiffs against FARE? Part 2

The current system extracts money from tenants through both the leverage listing agents and landlords have in a 1.4% vacancy rate environment and the confusion around agency. Only desperate tenants, not landlords, pay 15% fees, and only tenants confused by the current system pay agents they didn’t mean to hire. When FARE takes effect and tenants know that everything is “no fee” if they go directly, it affects these revenue streams.

While some individual rental agents will earn less, those at the top will be more affected, because it scales. If they can delay FARE even a few months with this lawsuit, it will be a financial windfall. The landlord plaintiffs, along with many of the agents/brokerages that testified against FARE in June, fall into that category. In my opinion.

I told you to put a pin in open listings…

Some landlords, like Greystar, Akelius, or BLDG, do most of their portfolio as “open listings” where the landlord does not hire one individual agent on an exclusive basis. Instead, any agent (they must be licensed and associated with a brokerage) can bring the tenant and collect a fee — from the tenant, landlord, or both — when they complete the transaction. This includes many, but not all, buildings with on-site leasing teams. An owner may have a signed agreement with a brokerage, but it will stipulate the relationship is NOT exclusive and any agent from any firm can bring the renter/buyer. The owner (and his leasing team, if applicable) can also seek tenants/buyers directly, cutting agents out entirely.

While open listings can technically be rentals or sales, in NYC the system is used by landlords with multi-building portfolios. These types of listings benefit the owner, who doesn’t need to hire one specific firm/agent and can still try to rent the place themselves, which isn’t allowed with exclusives. They give new agents an opportunity to advertise open listings and collect “leads.” And they earn money for companies like Rent Hop, which lets agents advertise open listings on its platform. The brokerage plaintiffs, according to their complaint, allow their agents to advertise open listings on their websites, so open listings also bring in leads and money for their leadership.

Notably, none of the major open listing landlords nor Rent Hop, which expressed concern about open listings and FARE before the hearing, are plaintiffs.

In the current system, sometimes the landlord pays the successful agent (“OP” or owner pays/”no fee”), sometimes the tenant pays, and sometimes the agent collects from both sides. Sometimes, a tenant could go directly to the building and pay no broker fee PLUS get a month of free rent, but if they go with an agent, the agent collects that one month instead. According to one former employee of several large management companies:

Our marketing teams typically had our leasing professionals do weekly audits of advertisements to see who was posting our listings so they could request they be taken down. And typically it was because the agent would advertise our concessions as “no fee” but they wouldn’t tell the resident it was concession or OP.

The lawsuit claims “open listings promote market transparency and consumer access to information” so their prevalence is a good thing. But I think it’s the opposite: these ads don’t necessarily provide consumers with accurate information and their prevalence is bad. If given the options of a landlord directly sharing the correct info directly with the public versus an agent inserting himself, giving incorrect info, and charging a fee, the better choice is obvious.

Let’s take this back to the discussion of “agency.” An agent puts an open listing, which has nothing to do with them (any agent could advertise/show the unit or the tenant could contact the landlord directly), on Rent Hop or an equivalent site. They show up as the listing agent (on at least one plaintiff site they are literally called the “listing agent”) and a tenant reaches out to view the apartment. The agent takes them to view the apartment, submits their application, and charges them a fee or takes the tenant’s free rent concession as payment. Or, in many cases, they collect from both sides. The agent has the tenant sign a document stating that the agent was representing the tenant, not the landlord.

Depending on the specifics, the agent may be doing the right thing per their brokerage. They may earnestly believe they did all that on behalf of the tenant. But think about it for a second and you’ll see the problem.

The agent did not advertise this unit “on behalf of the tenant.” They put it up so that they could earn money by renting it at a price specified by the owner.

They charged the tenant a fee not because the tenant wanted to hire them as a tenant-side agent; they made it seem necessary to rent the apartment.

The fee was set based on what they wanted or their brokerage’s guidance, not the tenant’s wishes.

When you look at what open listings really are, the landlord did hire the agent, just not specifically. When a landlord gives every brokerage an opportunity to bring the tenant and complete the transaction, you cannot claim to be working solely for the tenant. The landlord told you to bring them a tenant, so you did.

Do you see how difficult it is to legislate even something that seems conceptually simple? This is both why I think policy is amazing and also why it’s taken so long to pass something like FARE. Not only do you need to overcome the state’s most powerful lobbyists, but you need to work extremely hard to get the language right.

The Lawsuit

OK, that was a lot. So what is the actual claim?

REBNY et al. are making three claims against the FARE Act.

FARE violates agents’, brokerages’, and landlords’ right to commercial free speech.

FARE is invalid because real estate commissions are governed at the state level, so the city cannot legislate them (preemption).

FARE violates the US Constitution’s contracts clause.

Again, one more time: I am not an attorney. I have spoken to multiple attorneys, combined what they told me with my knowledge of brokerage/housing, and this is how I understand the case. As with everything in this post, it’s my opinion.

I’m starting each section with a screenshot from the complaint that illustrates the claim. I then include the response from an attorney named Roderick Hills, a “professor at New York University who focuses on constitutional and local government law,” that explains why he feels the suit will be dismissed.

Then, we get into my arguments. These are, in many cases, not legal arguments (again, not an attorney). I’m responding to the complaint and providing context for people who want more than just legalese. Lest we forget, messaging to the public is important.

Free Speech

The free speech argument seems to be about advertising open listings. Here’s the crux of it:

First up, here is what Mr. Hills told Curbed:

Obviously, I agree with him. But I also have thoughts.

First, FARE doesn’t change the definition of open listings. Agents who choose to advertise open listings already do so with no guarantee of payment.

Second, neither of the landlord plaintiffs seems to use an open listings model, so I don’t see how this has anything to do with them. Where is BLDG? Where is Related? Why don’t they care? The answer, I believe, is that landlords who choose to rent their portfolios as open listings don’t have a problem with FARE and don’t necessarily want so many agents advertising their apartments anyway (per the management employee quoted earlier).

As Mr. Hills notes, FARE does not say that agents cannot advertise open listings. It says they cannot advertise open listings and then make a tenant pay them a fee. Forcing the tenant to pay would violate the aim of FARE, which is to eliminate forced broker fees.

Finally, commercial free speech arguments, so I’ve heard, are generally kinda bullshit. I don’t see how this one holds water, especially to the point of overturning a law passed through the city’s exhaustive legislative process.

And, it’s worth noting, open listings cannot be advertised on REBNY or NYSAR’s platforms.

Preemption

Plaintiffs argue that real estate is regulated at the state level, so the city cannot pass any law regarding real estate conduct, advertising, or commissions.

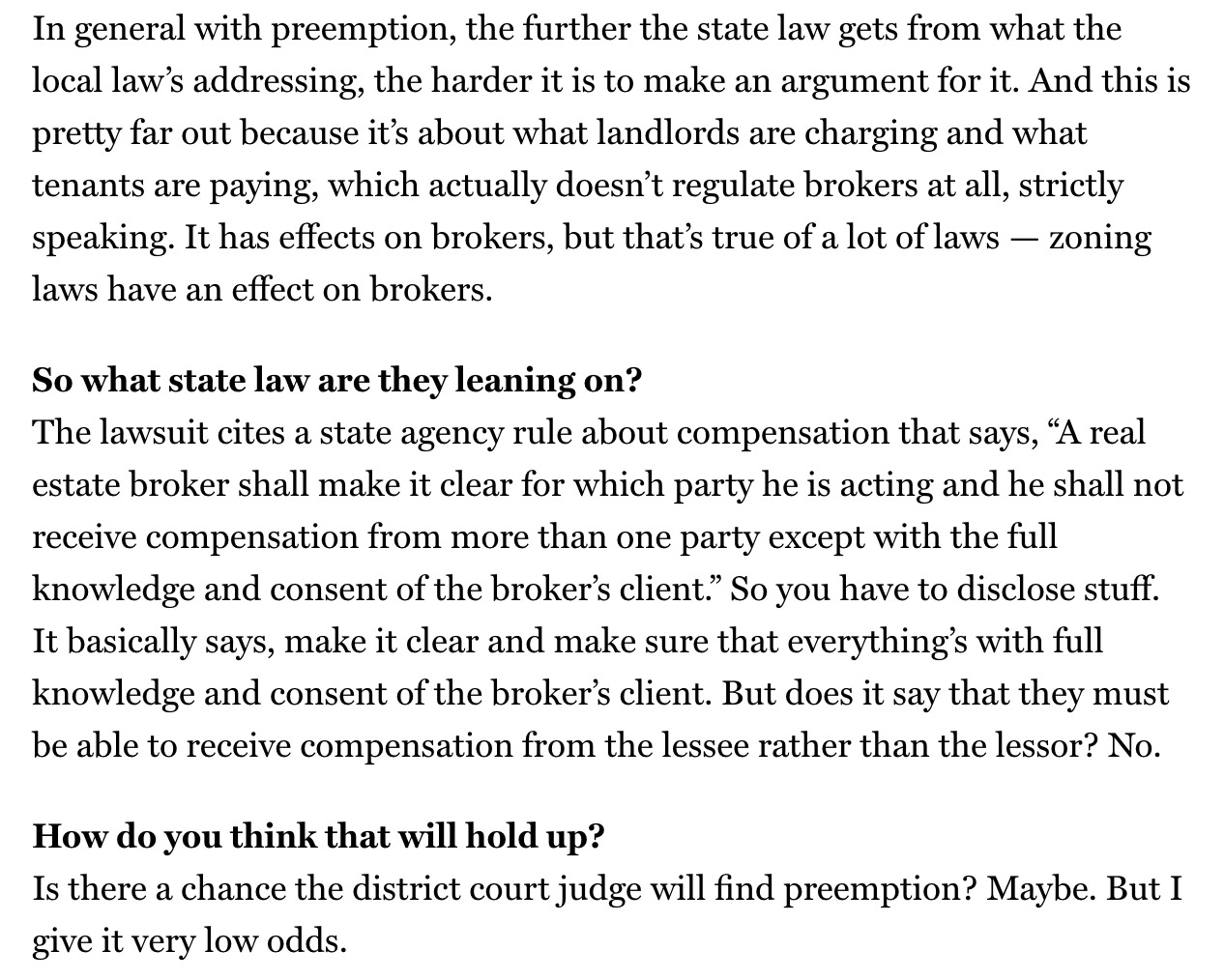

This is the argument we expected. From Mr. Hills:

RPL is “Real Property Law.” The referenced section outlines state requirements/fees to get a real estate license and says you cannot pay a salesperson or associate broker directly; all funds must go to the brokerage and then be dispersed. That’s why commission checks are written to an agent’s brokerage, not the individual agent. If an agent ever asks you to make a commission check out to them directly, don’t.

DOS, Department of State, requires certain information to be included when we advertise listings and says that dual agency is legal in NY, which is not the case in all states. But that’s really it (in my experience and opinion and etc).

The brokerage heads who testified with REBNY last June kept harping on dual agency, which I now believe was to further this preemption argument. However, as discussed earlier, many agents are not doing dual agency correctly, and there is no way to un-break the system without eliminating tenant-paid fees altogether. Adding more forms, as they suggest, does not work. And I doubt DOS would applaud a landlord representing his own property while making a tenant pay him a pre-determined fee.

I agree with everything Mr. Hills says and, furthermore, here’s how I know (as a person, not an attorney) that which party in a transaction pays an agent is actively NOT regulated at the state level: the effects of the NAR settlement.

If you missed it, there have been a slew of lawsuits regarding sales commissions. Brokerages and trade organizations/listing services were found to be engaging in anti-trust behavior by forcing sellers to pay buyers’ agents in addition to their own. Buyers and their agents were also unable to negotiate these commissions in their offers to sellers, and DOJ ruled the practice was unacceptable.

In New York, some brokerages are members of REBNY, others are members of NAR/NYSAR, and some are in both or neither. REBNY and NAR/NYSAR have rules that govern how agents at their member brokerages can collect commissions and stipulate when you have to share commissions with the other party versus when you don’t. These rules govern both sale and rental transactions.

In response to the NAR settlement, on January 1, 2024, REBNY changed its rules and updated the way these commissions were paid/negotiated. In August, NAR/NYSAR made a similar change. Were commissions and how they are paid regulated at the state level, as this suit claims, there would have been changes at the New York state level. There weren’t, because the state does not regulate who pays commissions in a transaction. We have state forms for things like agency disclosure and fair housing, but buyer broker forms and exclusive agreements are handled at the REBNY/NAR/brokerage level. Since the state is silent on who pays commissions in real estate transactions, my understanding is that the city is able to pass FARE.

Mr. Hills mentions that zoning is regulated at the city level. The law that eliminates Airbnb rentals was also passed at the city level.

As far as advertising, look at the battle between Compass’s CEO and NAR regarding “private exclusives.” In 2019, NAR introduced a policy called “Clear Cooperation” that requires listing agents to put a new property on the MLS (“multiple listing service,” how brokerages share listings) within 24 hours of sharing it within their brokerage. REBNY did not adopt the same policy, choosing instead to allow this type of listings with an opt-out form. So, in New York State, we have different rules about advertising listings, and what applies to you depends on the trade organization you belong to, not state law.

Hypocrisy isn’t legality but, as reported by The Real Deal, once “it became clear that a broker fee bill wasn’t going away, the Real Estate Board of New York pitched its own version to the City Council behind the scenes.”

If the city can’t regulate agents, how could it pass what REBNY proposed? Why did brokerage heads testify that the city council should set different regulations around our commissions, such as a one month cap, just not FARE? Could it be that they are fine with the city regulating our industry, but only if it does what they want?

As I see it, preemption is their best argument but still a ruse.

Contracts Clause

Plaintiffs argue that the city cannot pass any law impairing contracts between brokers and their clients.

Let’s start with Mr. Wills again:

Again, I agree, but I have a lot more to say about the plaintiffs’ claims on this one.

You probably noticed that the FARE Act did not take effect immediately. There is a 180 day delay between its passage and implementation. One reason is to avoid affecting existing agreements where the tenant is set to pay the landlord’s agent. The delay minimizes disruption and lets the majority of current deals run their course.

In my experience, most exclusive agreements are a maximum of six months long. They are regularly extended, but owners rarely want to be locked in an agreement with one agent/brokerage for a long time. Even when I represented 200+ unit buildings for a major landlord, our exclusive agreements were only a few months long at a time.

Many brokerage leaders have close personal and work relationships with the landlords they represent. Sometimes it goes even further, and there is common ownership. If the man who owns both Four Corners Realty and 21 West 74 Street has a five year contract with himself and wants to use that to overturn FARE, I don’t see how the court will allow it.

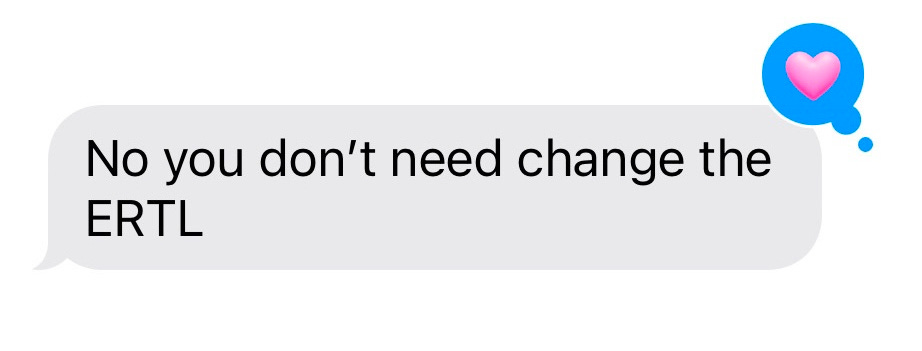

I kind of buried the lede here, because I don’t even think the length of the contracts is relevant. In reality, our contracts, called ERTL or Exclusive Right to Lease, often allow for a landlord to pay the broker fee even if the tenant was originally going to pay. See below exchange with my old manager; this was a listing that had been “tenant pays” (it’s a luxury price point and before the introduction of FARE, chill) but the owner ended up paying me instead.

If Compass’s exclusive agreements do not need to be changed when you collect a fee from the owner rather than the tenant, then, in my opinion, the allegation that “the FARE Act makes all tenant pays exclusive listings void and unenforceable” cannot be true. If you know me well, you’ll know this really pissed me off, which is why it’s in here. How are you going to put such an obvious falsehood in a legal document???

BOND’s exclusive agreements are mentioned specifically in the claim, and I have no personal knowledge of their agreements. Compass has thousands of agents active in NYC, a significantly larger market share than BOND’s 397 (according to its website). If BOND’s contracts are indeed rendered null and void, it appears they’re an outlier rather than the norm. And the point is moot, anyway. I will refer you back to Mr. Wills, an actual legal professional.

Oh, and if you want to laugh…

Apparently we didn’t prove that it would be easier for landlords to pay their own representation than it would be for tenants to pay. They conveniently ignore the fact that owners have no obligation to hire agents; they’re more than welcome to rent the place themselves.

Conclusion

Wow. What a mess. What now?

Oh, this is nothing. The more I looked, the more inconsistencies and concerning behavior, the more signs of a broken system where no one even knows the rules.

Which brings me to my real point, something I’ve touched on in the past: our industry needs FARE.

Agency laws are complicated, dual agency in rentals is risky, and agents regularly get sued. When an agent is sued or accused of violating tenant laws, they usually have to work with their brokerage’s attorney and pay a ~$5,000 deductible. This benefits no one (well, maybe the attorneys). Most agents do not set out to break laws intentionally, but it’s easy to mess up. FARE eliminates a whole host of ways agents can find themselves in legal trouble. FARE literally makes it easier for us.

I hope I’ve shown that the current rental market is a cesspool and that the tenant-pays model is terrible for agents and tenants alike. So many of us want this bill to pass, and even more would support it, I believe, if REBNY and brokerages would be honest about what FARE means.

I am not naive enough to think FARE will singlehandedly solve our affordability crisis, but I’m confident it will help. My goal with policy is to upstream problems as far as possible and pass the most targeted legislation with the largest downstream effects.

New Yorkers agree on FARE. Street Easy, which has more data than any brokerage or REBNY or NAR about the NYC rental market, agrees. A lot of agents agree. Even many landlords agree. These plaintiffs are part of a small, loud minority that is used to getting its way. I get why why filed this suit; they had to try. But I sincerely hope that the case is dismissed and laughed out of a courtroom.

Thanks for reading this absolute novel. Bye bye, broker fees.

xo

Anna