What's going on at 8 West 119th Street?

Why is a city-subsidized co-op acting like a rental? And why is it fighting to protect broker fees?

In December, Intro 360 or “FARE” became law. Two days later, REBNY — along with NYSAR, five brokerages, and two landlords — sued to block the bill. Put simply, a group that benefits from tenants paying broker fees wants it to stay that way, and this is their hail Mary pass. It’s not compelling, and if it isn’t dismissed outright it’s likely to fail pretty quickly.

But this isn’t about the lawsuit. It’s about one of the “landlord” plaintiffs, 8 West 119th Street, an HDFC income restricted co-op.

When I saw “HDFC” on the complaint, I was confused; these are highly regulated and subletting is barely allowed. Why do they care about broker fees? Why would they agree to be a part of this lawsuit? What is going on???

Some notes before we begin:

I am only sourcing information from publicly available sites (mostly just from StreetEasy). Anyone could find this.

Even though it’s public information, I am not using any individuals’ names.

Even though it’s public information, I am not going to teach you to how to search government records in this post.

What is an HDFC co-op?

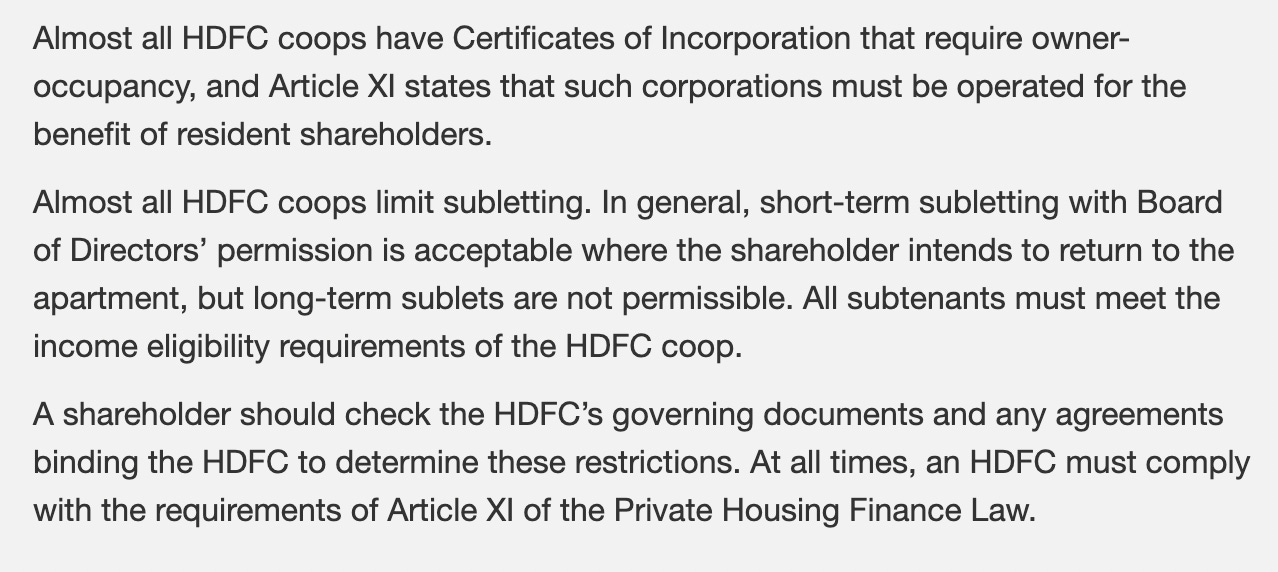

Let’s start with the basics. An HDFC co-op is an income restricted building with apartments for purchase rather than rent. Unlike Mitchell Llama, which is run by the city and takes applications via lotteries, they function independently on the resale market, but with specific guidelines. They are intended as low-cost buying opportunities for people who fit certain requirements. They are NOT meant to be rental buildings; there should be no long term renting and rentals in general must be limited. From HPD:

How do you buy an HDFC?

The purchase process (on the resale market, at least) is similar to other co-ops. You find them listed online, usually need a minimum of 20% down, have to complete a board package, etc. There is extra paperwork to file with the government. But you must also fit specific income requirements determined by the co-op’s agreement with the city.

When you sell, the city also has requirements. The purchase price must be low enough that someone within the income bracket would pay no more than 1/3rd of their gross income on their mortgage, maintenance, and utilities. The seller cannot get a financial windfall, and “flip taxes,” or payments to the co-op when a sale closes, can be as high as 30% of the profit. By comparison, most other co-ops have flip taxes ranging from 0-3%.

The whole point of these buildings is that the city funded their creation and rehabilitation, then gave existing tenants a path to ownership for extremely low prices, and now continues to give owners a break on property tax. In exchange, the building must continue to offer a similar path to prospective buyers.

Seems like a great deal, honestly. But is that what 8 West 119th Street doing? Doesn’t seem like it.

So what’s up with 8 West 119th Street?

Here’s how the suit introduces this plaintiff.

According to the complaint, the ownership of 8 West 119th Street (the “cooperative”) keeps four out of 20 total units (20%) off the sales market and rents them out instead. It appears that Bohemia, another plaintiff, has taken over the leasing. They rented out four units in 2024 and an additional unit in 2025. It’s not unreasonable to assume that Bohemia, whose co-owner has been one of the loudest voices against FARE, had something to do with the co-op joining the complaint.

The other two rentals were listed by a self proclaimed broker/owner of one of the other units, who is an agent at Brown Harris Stevens. Her firm is not one of the plaintiffs, but its CEO is another loud voice against FARE, testifying along with REBNY at the hearing. To this agent’s credit, it appears she did not charge tenants a broker fee for either of her 2024 rentals (the same cannot be said for Bohemia). To her not-credit, it appears she may own multiple units in the building, renting at least one out for a profit.

But OK, why is this an issue?

Issue 1: Income Restrictions

None of the rental listings mention an income restriction. If the plaintiffs involved in these transactions have been accepting tenants who earn more than the income restrictions placed on the building, I believe that violates the terms of classification as HDFC.

Now’s as good a time as any to point out that when there is a rent concession, the broker fee is generally based off the gross rent rather than the net, which makes it a higher number.

Issue 2: Rent Stabilization

Because HDFCs are not meant to be used as rental properties, I can’t tell from HPD’s site whether they must be treated as stabilized. If they are, any leases must be specific, rent stabilized leases, the rents need to be reported to HPD, and increases must align with percentages set by the Rent Guidelines Board. If they are renting these units out continually and raising rents with the market instead of stabilization requirements, that also feels like a violation of HDFC status. And, in the above situation, where there is a free month, are they basing increases off the “net” or “gross” rent?

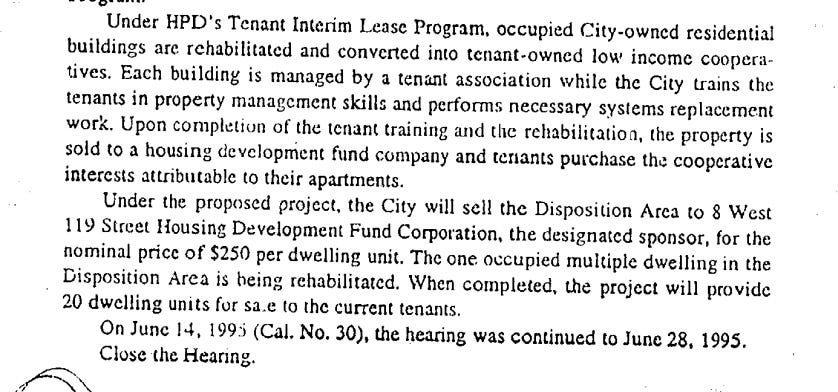

Eight of the total 20 units (40%) have been listed for rent on StreetEasy in 2023, 2024, or 2025. Nearly half of the building’s stock may currently be rented. Again, this does not feel in keeping with the rules HPD has for HDFC co-ops. The whole point of these buildings, and the reason they get tax breaks and incentives, is because they are meant to provide a path to low-cost home ownership. It looks like the last actual sale was a decade ago.

And as the complaint itself explains, this isn’t simply the building cutting owners slack and allowing them to sublet their places out of necessity.

Issue 3: Renting Instead of Selling

This breaks my heart. Instead of selling affordable units to people in need during a housing crisis, the building appears to be renting them out at market rate.

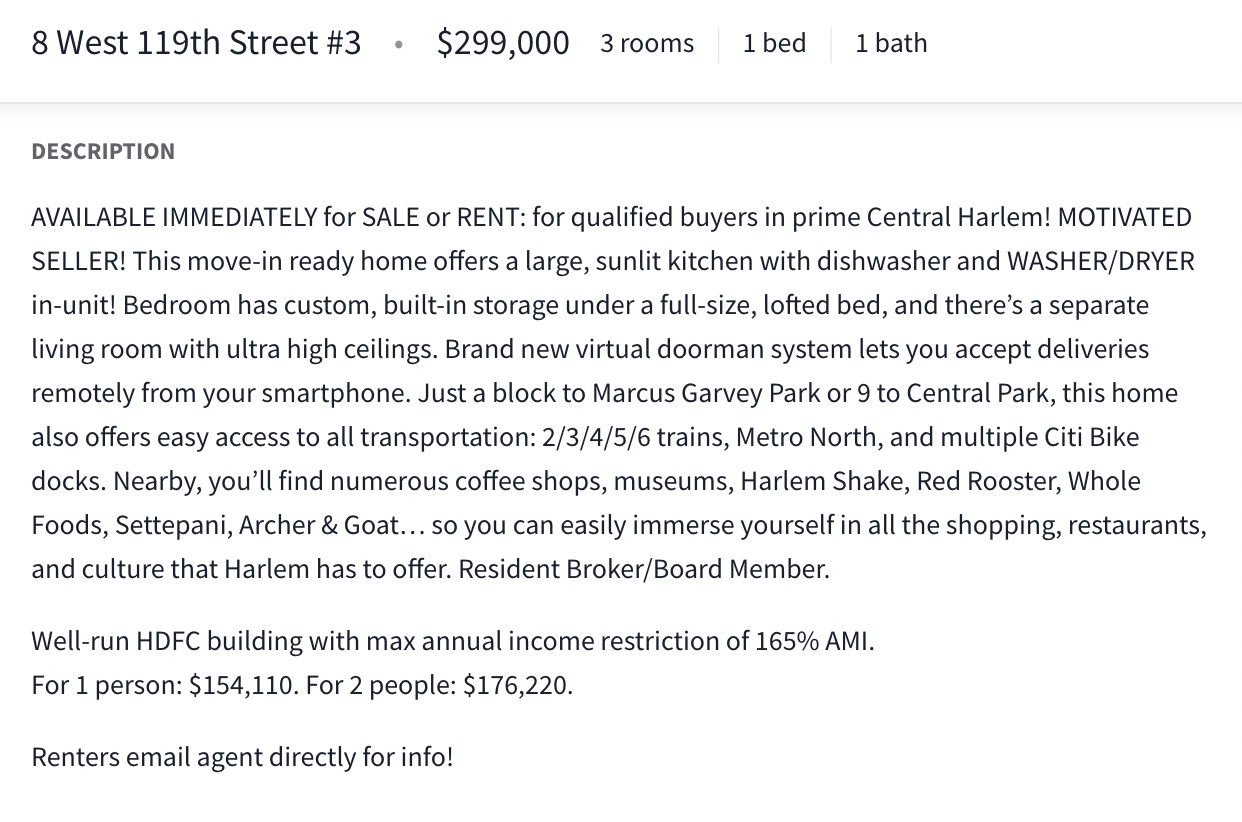

In 2022, one apartment was listed for sale, but they listed it for rent at the same time. If they didn’t have purchase offers, they could have dropped the price, but they didn’t. If the excuse is that a buyer cannot get traditional financing because too many of the units are being rented out, other types of loans may work. I don’t see a reason they had to rent instead of selling.

Because the unit was delisted and there is no sale or transfer record in ACRIS, I believe it was rented instead. It was rented out again this year by the same agent. HPD’s site specifically says that HDFC units should not be rented out in perpetuity, and it appears that Unit 3 has been rented for three years straight. I don’t know what the rent was in 2022, but if we knew that we could also gauge whether increases have followed rent stabilization guidelines or if they’ve been set by the market.

Issue 4: Taxes

Everything I just showed you is from StreetEasy and HPD’s website. I did not have to do any specific digging to get this information; I just knew what to look for, which Bohemia, REBNY, et al. should also know. That’s why I’m so shocked that 8 W 119th is one of the plaintiffs.

I did go a little deeper to basically “double check” my work. If you want to read the co-op’s deed with the city, you can find the whole thing here. It’s from ACRIS, meaning it’s also publicly available information. As you can see from the below screenshots, the building’s partial tax exempt status runs until 2029 and requires the co-op to operate under the laws governing HDFCs.

It appears that this building benefits from tax incentives without fulfilling the requirements to get said benefits. This is a common problem in rent stabilized housing, as well. Per this screenshot, “such partial tax exemption shall terminate if…not operating the housing project in accordance with the requirements.” This is why I don’t understand their sign-on to the lawsuit. You were successfully flying under the radar; why Icarus yourself?

Conclusion

This really sucks. It’s far from the only HDFC acting inappropriately, but this is brazen. It feels like owners who benefitted from a system no longer available to those in need, then cut the ladder down after them.

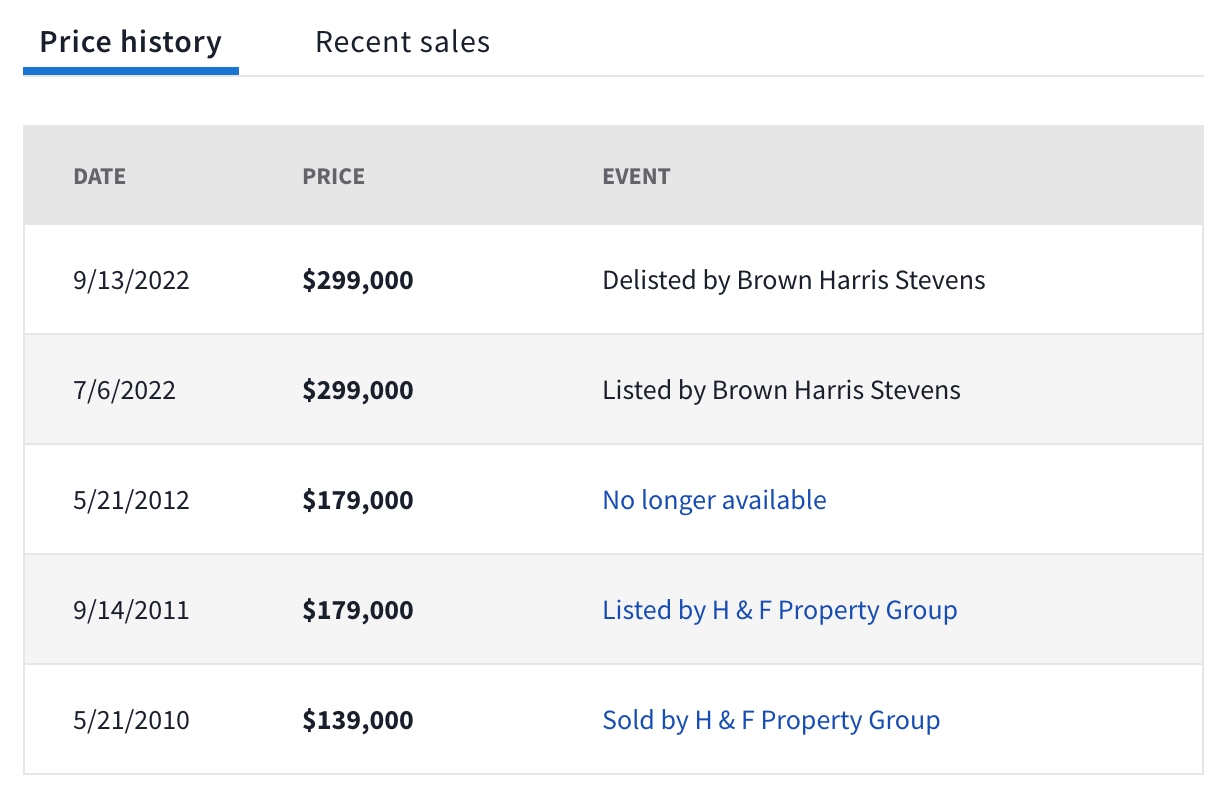

HDFC buildings were created several decades ago when the city allowed tenants in buildings with derelict landlords to form co-ops and take over their buildings. Some residents bought their apartments for $250 apiece, according to a 2014 article in The New York Times—and yes, that's the correct number of zeroes.

I don’t know that 8 W 119th is technically breaking the law. I’m not an attorney and there is a lot of leeway and vagueness in the requirements listed by HPD. But it sure feels like this is a step too far, and I think it’s important to call out this type of behavior to point out problems of which most consumers are unaware.

The “sponsor” paid a total of $5,000 for the building, or $250/unit.

Stay angry, my friends. And be wary of anyone promising you that regulation and “affordable housing” alone can solve our housing crisis. Until we have an appropriate amount of supply, no bandaids will be enough. Inequity will look different, but it will still be rampant. Let’s hold people accountable and freakin’ BUILD.

xo

Anna